Hourly wage plus overtime calculator

Apply to Production Associate Inspectorpacker Server and more. Big on service small on fees.

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Public employees exempt employees paycheck calculation.

. General Schedule GS Salary Calculator. 401k 125 plan county or other special deductions. Ad Create professional looking paystubs.

If you earn 835 per hour work 50 weeks a year and. 15hour 45 hours 675 plus 200 commission 875 base pay for the week. Hourly Wage Tax Calculator 202223.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The federal minimum wage provisions are contained in the Fair Labor Standards Act FLSA. Ad Run your business.

All Services Backed by Tax Guarantee. The federal minimum wage is 725 per hour effective July 24 2009. We use the most recent and accurate information.

For example if an employee makes 25 per hour and. Since overtime pay starts after 40 hours worked a week according to FLSA rules calculate the employees regular wages using the regular hourly rate. Many states also have.

Calculate the number of hours you work per week by multiplying the hours you work per day by the number of days you work per week. The overtime calculator uses the following formulae. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Open with Maximum Telework Flexibilities to all current telework eligible employees pursuant to direction from agency heads. Then multiply that number by the total number of weeks in a year 52. Well run your payroll for up to 40 less.

See where that hard-earned money goes - Federal Income Tax Social Security and. Ad Payroll So Easy You Can Set It Up Run It Yourself. If you expect the.

See where that hard-earned money goes -. Overtime pay is often more than the regular hourly rate too. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Get your payroll done right every time. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. Total Weekly Pay Regular Weekly Pay Overtime Weekly Pay.

A common rule is that overtime pay must be 15 times the regular rate of paycommonly called time and a half. The new base must be calculated using the total regular pay. In our example the result would be 40 hours 8.

The FLSA does not require overtime pay for work on Saturdays Sundays holidays or regular days of rest unless overtime is worked on such days. Multiply the hourly wage by the number of hours worked per week. Wage and Hour Division.

Its set to raise the standard salary to over 35000 annually. 87545 hours 1944-per-hour. Flexible hourly monthly or annual pay rates bonus or other earning items.

The new guidelines which will be effective on January 1 2020 states the following principles. In a few easy steps you can create your own paystubs and have them sent to your email. Total Salary Weekly Pay x Work Weeks per Year.

DOL is increasing the.

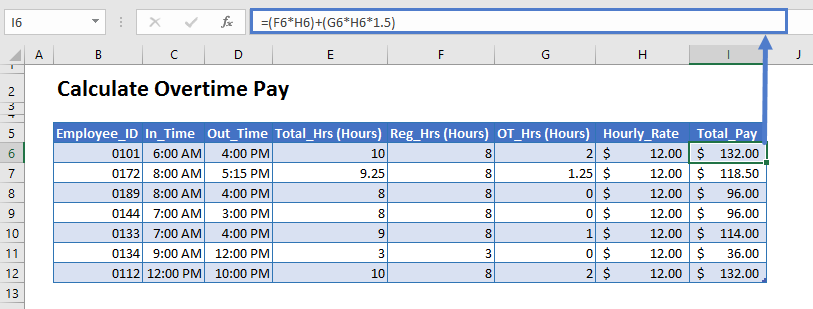

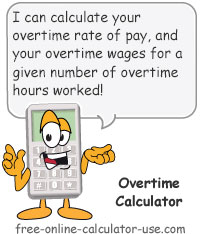

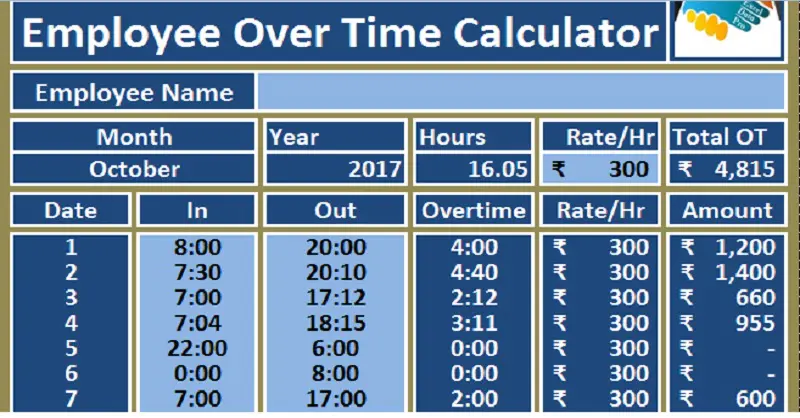

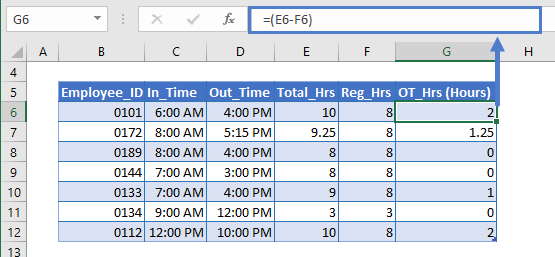

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Calculators

Calculate Overtime In Excel Google Sheets Automate Excel

5 2 Overtime Wages Better Work

Overtime Calculator To Calculate Time And A Half Rate And More

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Basic Wages And Overtime

How To Quickly Calculate The Overtime And Payment In Excel

Download Employee Overtime Calculator Excel Template Exceldatapro

Overtime Pay Calculators

Overtime Calculator

Overtime Pay Calculators

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Excel Formula Basic Overtime Calculation Formula

How To Calculate Overtime Pay Youtube

Calculate Overtime In Excel Google Sheets Automate Excel

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide